Your 30s are a critical decade for establishing a strong financial foundation. This is the time when careers begin to stabilize, families may start to grow, and long-term responsibilities become more real. To ensure financial security and future prosperity, setting clear financial goals in your 30s is essential. These goals will not only protect you against unexpected life events but also help you build wealth for retirement and beyond.

Below are key financial goals you should prioritize during your 30s, along with strategies to help you achieve them.

Build an Emergency Fund

Why It Matters

An emergency fund provides a financial cushion for unexpected events such as medical emergencies, job loss, or urgent home repairs. Without one, you risk falling into debt or disrupting your long-term goals.

How to Start

Aim to save at least 3 to 6 months’ worth of essential expenses. Start small if needed and build up gradually. Keep this fund in a separate, easily accessible savings account to avoid temptation.

Eliminate High-Interest Debt

Focus on Credit Cards and Loans

High-interest debt, especially from credit cards or personal loans, can significantly hinder your financial progress. It eats into your income and reduces your ability to save or invest.

Create a Debt Repayment Plan

Use strategies like the debt avalanche (paying off high-interest debt first) or the debt snowball (paying off the smallest balance first). Automate payments to stay on track and avoid penalties.

Create a Monthly Budget

Track Income and Expenses

Budgeting helps you take control of your money and understand where it’s going. Use digital tools or spreadsheets to monitor your income and categorize spending.

Adjust Based on Priorities

Make sure your budget aligns with your goals. Allocate money to savings, debt repayment, and investing before non-essential expenses.

Begin Investing Consistently

Time Is Your Greatest Asset

The earlier you start investing, the more time your money has to grow through compound interest. Even small amounts invested regularly can lead to substantial gains.

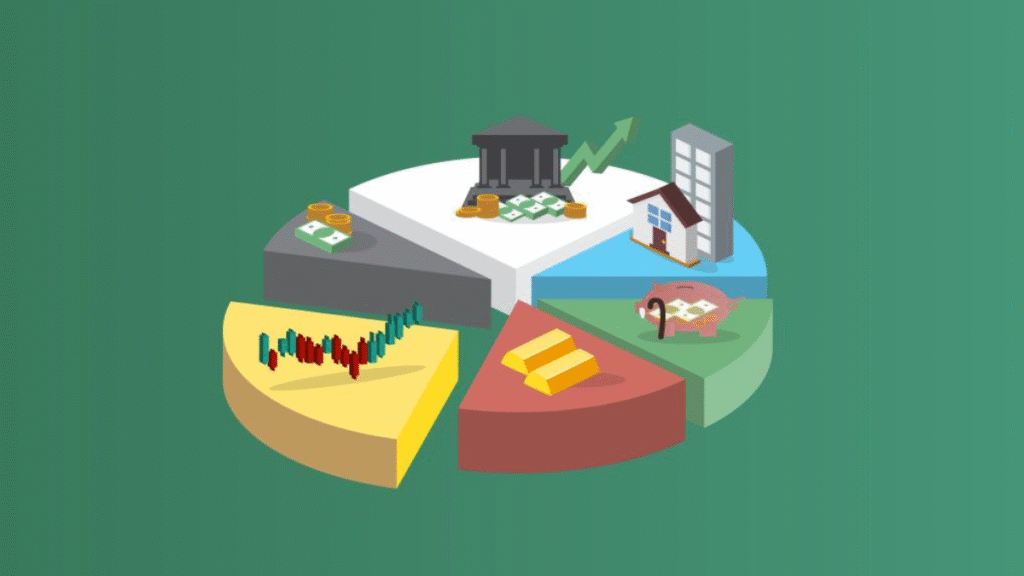

Use Diversified Strategies

Focus on building a diversified portfolio. Include a mix of asset types that match your risk tolerance and long-term objectives. Consider mutual funds, index funds, or ETFs.

Set Retirement Goals

Don’t Delay Retirement Planning

Waiting until your 40s or 50s to plan for retirement can result in a financial crunch later. Your 30s are the best time to start saving for a comfortable retirement.

Automate Contributions

Set up automatic monthly contributions to a retirement fund. Increase your contributions when your income grows or expenses drop.

Plan for Major Life Events

Marriage, Children, or Home Ownership

Life events often come with significant financial implications. Preparing in advance allows you to manage these costs without derailing your other goals.

Set Short- and Long-Term Targets

For example, if you plan to buy a house in five years, create a savings plan that helps you build an adequate down payment while managing other financial responsibilities.

Get Adequate Insurance Coverage

Protect Your Assets

In your 30s, you likely own more than you did in your 20s—whether it’s a home, car, or growing family. Insurance helps protect these assets from loss or damage.

Types to Consider

Look into health, life, auto, disability, and renters or homeowners insurance. Ensure you understand your coverage and review your policies annually.

Start Saving for Children’s Education

Education Costs Are Rising

If you have or plan to have children, start saving for their education as early as possible. Tuition and other academic expenses can become overwhelming later.

Use a Separate Fund

Open a dedicated education savings account or similar financial product to separate this goal from your other savings or retirement plans.

Improve Your Credit Score

Long-Term Financial Health

A good credit score is vital for qualifying for better interest rates on loans, mortgages, and even insurance premiums.

Maintain Responsible Habits

Pay bills on time, keep credit utilization low, and avoid unnecessary credit inquiries. Monitor your credit report for errors and correct them promptly.

Create a Will and Estate Plan

Protect Your Loved Ones

It may seem early, but having a will ensures your assets are distributed according to your wishes. Estate planning also includes setting up powers of attorney and health directives.

Revisit as Life Changes

Update your estate plan as your family and financial situation evolves. This helps prevent legal complications later.

Maximize Your Income

Invest in Skill Development

Your 30s are a great time to boost your earning potential. Take courses, earn certifications, or consider side hustles that align with your strengths and interests.

Negotiate Your Salary

Don’t settle for less than you’re worth. Negotiating a raise or seeking better-paying opportunities can significantly impact your long-term wealth.

Build Passive Income Streams

Diversify Income Sources

Relying solely on a salary can be risky. Explore income sources like real estate rentals, dividend-paying investments, or online businesses.

Start Small and Scale

Test various passive income ideas and invest more in what works. These income streams can provide security and even fund early retirement.

Evaluate and Adjust Financial Goals Annually

Stay on Track

Your life circumstances, priorities, and income will change over time. Annual reviews help you stay aligned with your broader financial vision.

Use SMART Goals

Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound. This approach makes them more actionable and trackable.

Also Read : How To Build An Emergency Fund From Scratch

Conclusion

Your 30s are a transformative decade—a time when setting the right financial goals can make all the difference in your long-term security and prosperity. From building an emergency fund to investing for retirement and planning for major life events, each financial move you make now lays the groundwork for a future free of stress and full of opportunity.

Start with simple steps. Focus on clearing debt, building savings, and understanding your financial picture clearly. As you grow, so will your confidence and financial stability.

Setting these goals now won’t just benefit you today—it will secure your tomorrow.

FAQs

What’s the most important financial goal in your 30s?

The most important financial goal is building an emergency fund, as it protects you from unexpected expenses and prevents debt accumulation.

How much should I save for retirement in my 30s?

A good rule of thumb is to save at least 15% of your annual income for retirement, adjusting based on your desired retirement age and lifestyle.

Should I focus on saving or investing in my 30s?

Both are important. Begin with saving for emergencies and short-term goals, then start investing for long-term wealth growth.

Is it too late to start budgeting in your 30s?

Not at all. Your 30s are a perfect time to start budgeting, especially as your expenses and responsibilities increase.

How often should I review my financial goals?

Review your financial goals at least once a year or whenever you experience major life changes like marriage, a new job, or having children.