Debt can feel like a heavy burden, stealing your peace of mind and limiting your financial freedom. But the good news? You don’t have to stay stuck. With a clear plan, discipline, and the right strategies, you can get out of debt faster than you think.

This comprehensive guide will help you create a solid action plan to eliminate your debt quickly and regain control of your finances.

Understanding the Root of Your Debt

Before jumping into solutions, you must understand how you got into debt in the first place. This isn’t about guilt—it’s about clarity.

Common Causes of Debt

- Overspending on credit cards

- Emergency expenses without savings

- Medical bills

- Student loans

- Poor budgeting habits

- Job loss or reduction in income

Identifying the cause helps you prevent repeating the same mistakes in the future.

Step-by-Step Guide to Get Out of Debt Fast

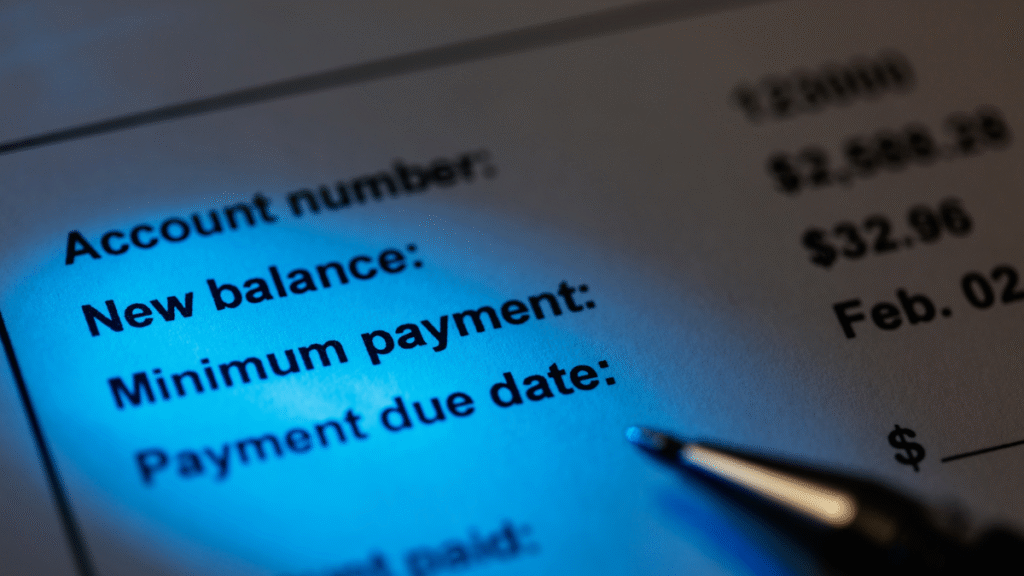

1. Assess Your Financial Situation

Start by listing all your debts—how much you owe, the interest rates, and the minimum monthly payments. This gives you a clear picture of your total debt.

Create a debt inventory:

- Total balance

- Interest rate

- Minimum payment

- Due dates

2. Stop Accumulating More Debt

This is the most critical step. If you’re trying to pay off debt while continuing to use credit, you’re digging a deeper hole.

Action Steps:

- Stop using credit cards temporarily

- Avoid financing new purchases

- Delay big expenses

3. Create a Realistic Budget

A budget is the foundation of any debt repayment strategy. It shows you where your money is going and helps you redirect funds to pay off debt.

Tips for a strong budget:

- Track all income and expenses

- Categorize essential and non-essential spending

- Allocate a portion toward debt repayment

- Include a small savings buffer for emergencies

4. Build a Starter Emergency Fund

Even while paying off debt, you need a small emergency fund to avoid going further into debt when the unexpected happens.

Start with a goal of ₹10,000–₹20,000, depending on your situation.

5. Choose a Debt Repayment Strategy

There are two popular methods to pay off debt quickly:

Debt Snowball Method

- Pay off the smallest debts first

- Gives psychological momentum

- Good for motivation and quick wins

Debt Avalanche Method

- Pay off the highest-interest debt first

- Saves the most money in the long run

- Best for reducing total interest paid

Choose the method that works best for your mindset and financial goals.

6. Make Extra Payments Whenever Possible

Every extra rupee you put toward debt shortens your repayment timeline.

Ways to make extra payments:

- Use bonuses, tax refunds, or gifts

- Sell unused items

- Take on part-time or freelance work

7. Cut Unnecessary Expenses

Reducing your monthly expenses can free up more money for debt repayment.

Cut or reduce:

- Streaming subscriptions

- Dining out

- Impulse online purchases

- Gym memberships

- Expensive hobbies

8. Increase Your Income

Earning more can accelerate your debt-free journey. Look for side income opportunities that fit your schedule.

Ideas:

- Freelancing

- Tutoring

- Selling crafts or handmade goods

- Online services

- Part-time weekend work

9. Negotiate Lower Interest Rates

Contact your creditors and request a lower interest rate. If you’ve been a loyal customer and have a good payment history, they may agree.

Prepare before calling:

- Know your payment history

- Mention competing rates

- Be polite but firm

10. Prioritize High-Impact Debts

Some debts are more dangerous than others—especially those with high interest or penalties.

Focus on:

- Credit card debt

- Payday loans

- High-interest personal loans

These eat away at your income the fastest.

11. Use the 50/30/20 Rule

This budgeting strategy helps you divide your income wisely:

- 50% for needs

- 30% for wants

- 20% for debt repayment or savings

If possible, adjust to a 40/20/40 plan to pay off debt more aggressively.

12. Automate Your Payments

Setting up automatic payments ensures you never miss a due date, helping you avoid late fees and interest penalties.

Benefits:

- Improved credit score

- Stress-free payments

- Faster debt payoff

13. Track Your Progress

Seeing your debt shrink month by month keeps you motivated.

Ways to track:

- Use budgeting apps

- Maintain a debt tracker journal

- Celebrate milestones

14. Avoid Lifestyle Inflation

When your income increases, it’s tempting to spend more. But while in debt, keep your expenses the same and channel the extra income toward repayments.

15. Change Your Money Mindset

To stay debt-free, shift your mindset:

- Avoid emotional spending

- Focus on long-term financial goals

- Embrace frugal living

Mistakes to Avoid While Getting Out of Debt

1. Only Paying the Minimum

Minimum payments keep you in debt longer and cost more in interest. Always try to pay more when possible.

2. Ignoring Your Credit Score

Your credit score affects your ability to negotiate lower rates or future financial opportunities. Monitor and protect it.

3. Taking on New Loans to Pay Old Ones

This often leads to a cycle of more debt unless done through a well-structured consolidation plan.

4. Not Having a Support System

Talk to a trusted friend or join online communities focused on debt freedom. Encouragement helps.

Benefits of Becoming Debt-Free

- Reduced financial stress

- Increased savings and investment potential

- Greater freedom to make life choices

- Improved credit score

- Ability to build wealth faster

Also Read : Financial Planning Tips For Young Adults

Conclusion

Getting out of debt quickly is possible—it just takes a focused strategy, consistency, and commitment. Start by analyzing your financial habits, set a clear goal, and follow a plan that fits your lifestyle. With each payment, you’re buying your freedom. Stay patient, stay motivated, and soon enough, you’ll be celebrating your debt-free life.

FAQs

1 How long does it take to get out of debt?

It depends on the total amount of debt, your repayment strategy, and how much you can pay monthly. With aggressive budgeting, many people can become debt-free in 12–36 months.

2 Should I pay off the smallest debt first or the one with the highest interest?

If you want quick wins, pay off the smallest debt (snowball method). To save money in the long run, focus on high-interest debt (avalanche method).

3 Can I pay off debt while saving money?

Yes. Build a small emergency fund to protect yourself from future debt, then focus aggressively on debt repayment.

4 Is debt consolidation a good idea?

It can be helpful if it reduces your interest rate and simplifies payments. But it’s not a solution if you continue overspending.

5 What if I don’t make enough money to pay off debt?

Start with a strict budget and look for ways to earn extra income. Every small effort helps. Even increasing your payments by ₹1,000/month can make a big difference over time.